- Ace in the Hole

- Posts

- Ace in the Hole - Edition #12

Ace in the Hole - Edition #12

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody enjoyed the weekend, but it’s time to get back to work!

Last week we saw the S&P 500 rise another .98% after doing 1.67% the week prior.

GDP and PCE came out which brought a decent amount of volatility to the market and brought the whole crew some beautiful price action to capitalize on.

Day Trading Thoughts

Follow the trend! I’ve had a few moments where I’ve flipped bearish for a very short period of time. As you can see from the charts, there are no shorts on the $SPY that are favorable in my opinion.

I will not try and short this strength until it actually gives me something to go off of.

IT IS NOT THE WISEST TO SHORT A MARKET THAT IS CONTINUOUSLY MAKING HIGHER HIGHS AND HIGHER LOWS.

Short-Term Setups For This Week:

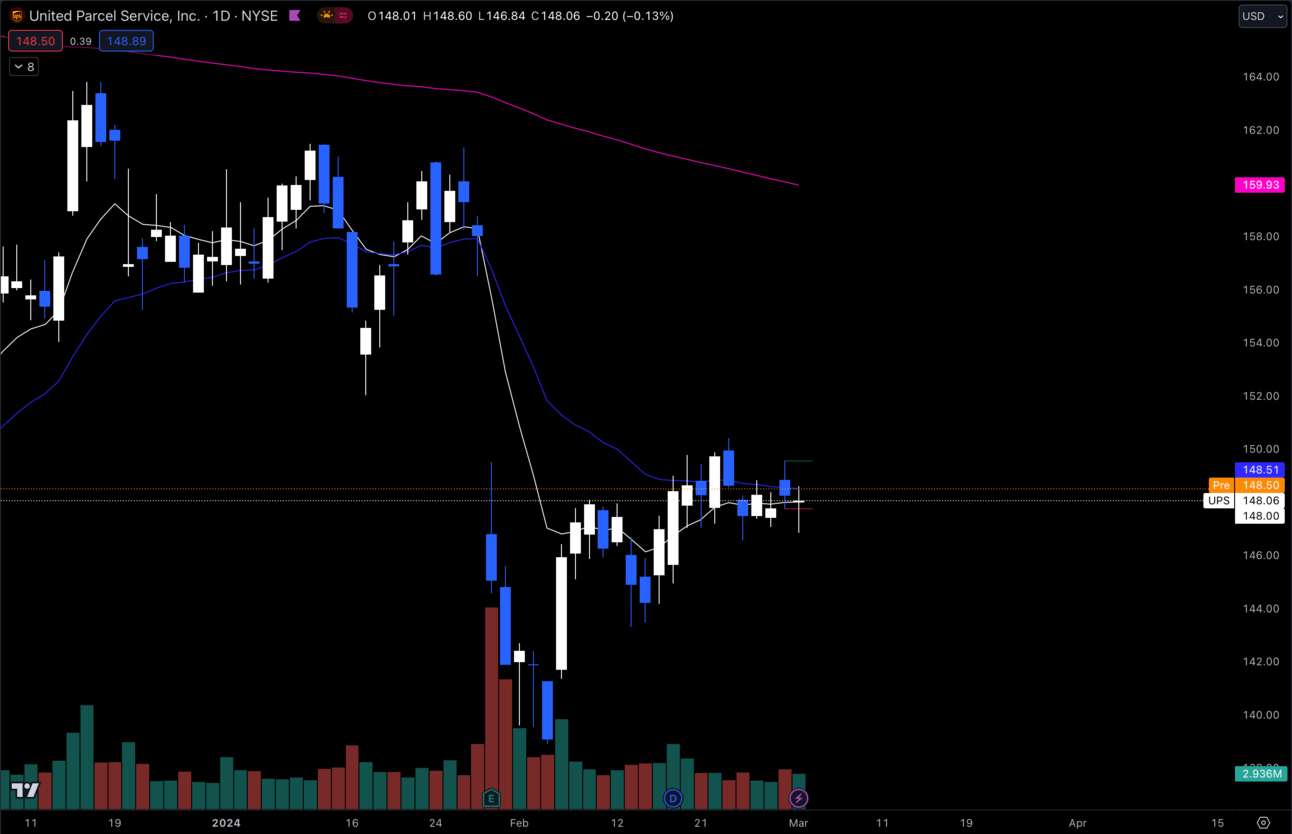

1. $UPS

$UPS Daily

I’ve been keeping an eye on $UPS at these levels. It has started making higher lows and higher highs up to the beginning of the gap.

I’m looking for this gap to fill to the upside this week which goes from $149.50 —> $156.50.

Under $146 invalidates my thesis here.

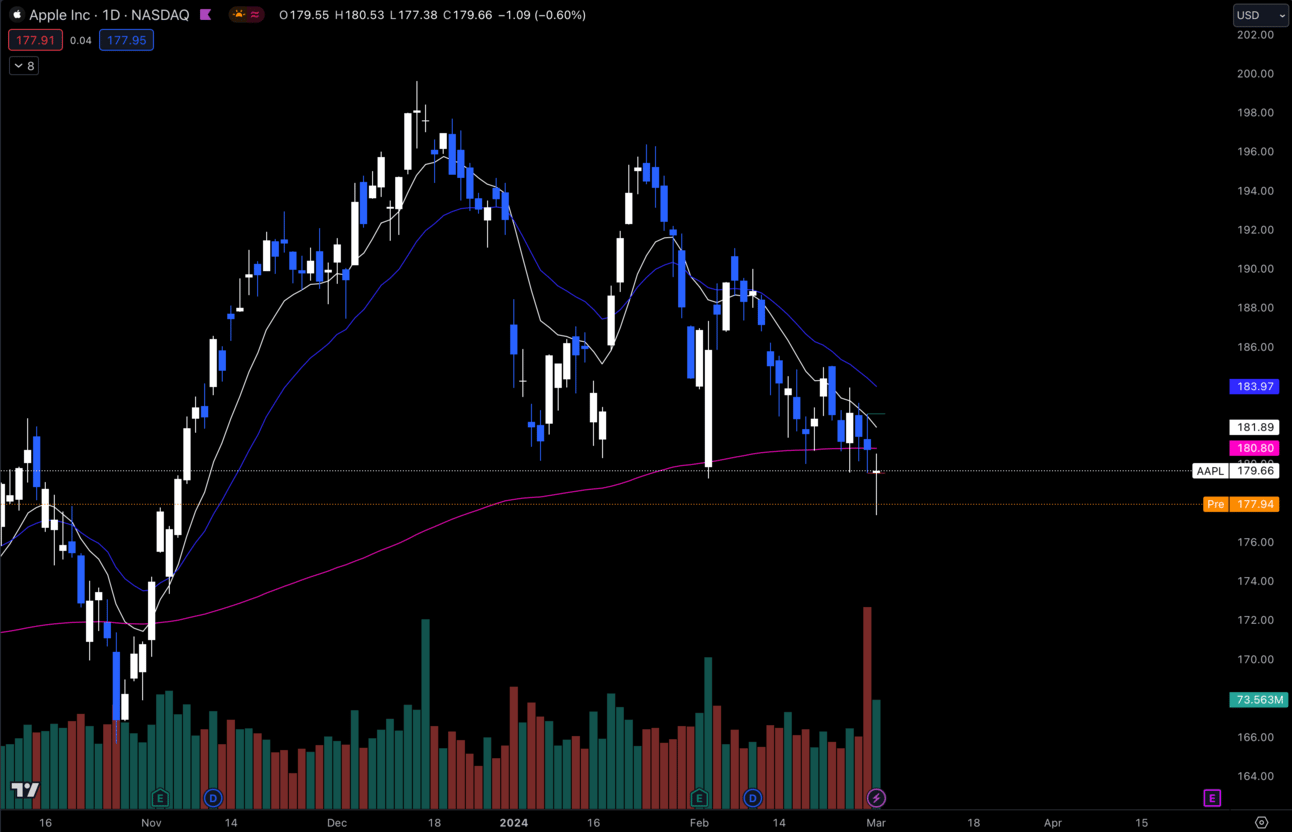

2. $AAPL

$AAPL Daily

Last week I talked about possible shorts on $AAPL if we broke below that 180 demand area.

$AAPL broke it, but as you can see there has been no follow through to the downside.

I’m curious if we are seeing a bit of a fake out breakdown, so I’m keeping my eye on it. If $AAPL catches a bid and $MSFT continues for new highs, we could see this market continue ripping.

I’d like to see $AAPL reclaim 180 and hold above for me to think about the longs.

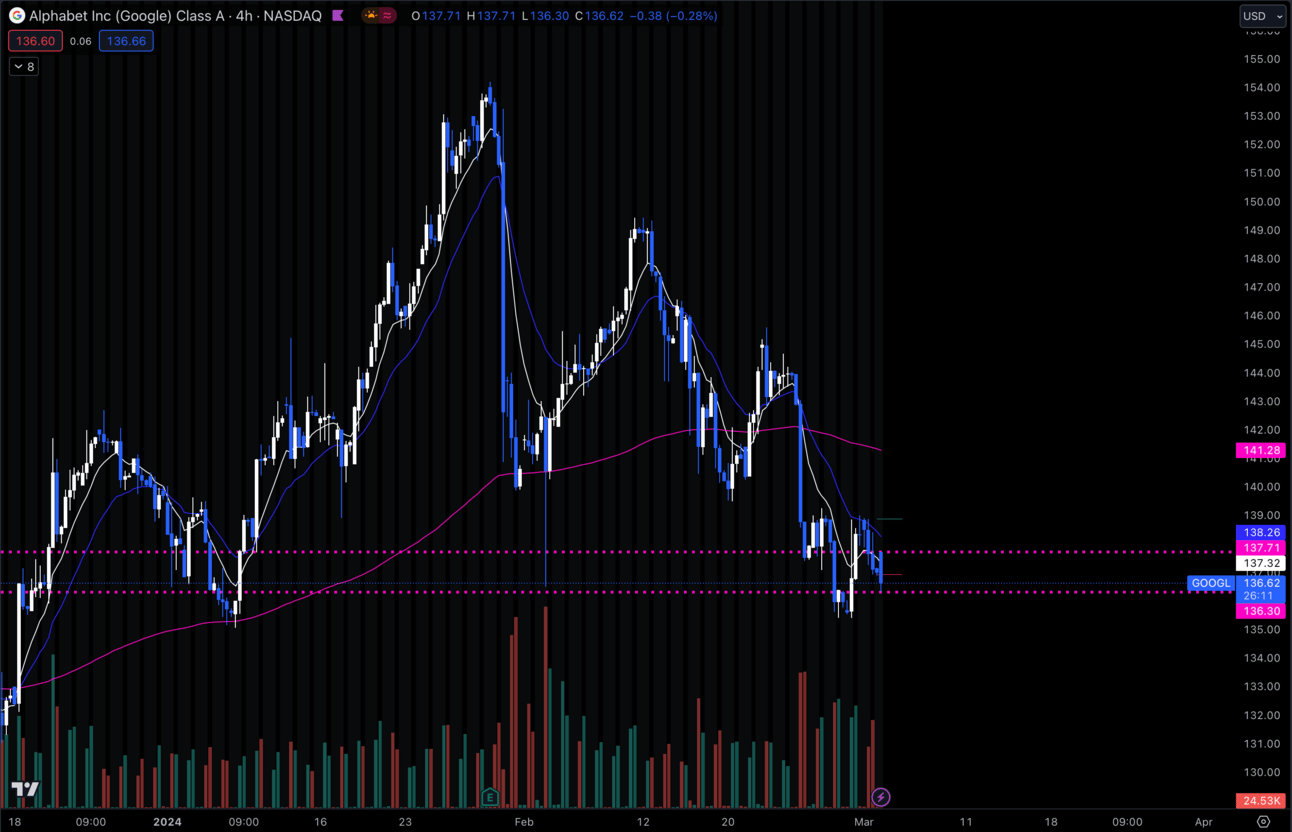

3. $GOOGL

$GOOGL 4 Hour

$GOOGL has been underperforming the past few weeks compared to $SPY, so I’m curious to see if we try and make a higher low on the 4 hour to try and reverse back to the upside.

Holding that pre market low is key and for calls I’d really like to see over $140.

I definitely think there is potential here as it’s been underperforming, especially if $AAPL picks it up and $MSFT breaks out.

Long-Term Setups For This Week:

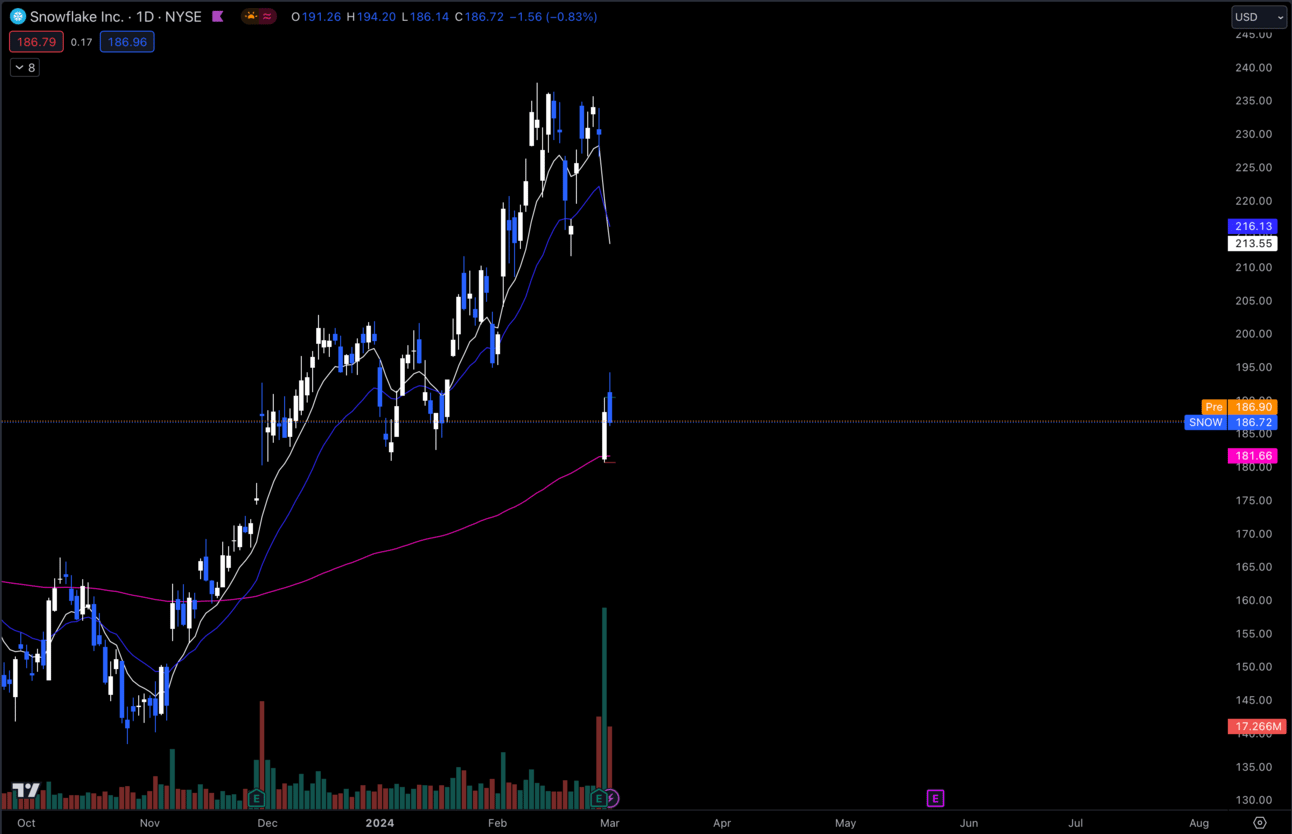

1. $SNOW

$SNOW Daily

$SNOW got hit hard on earnings after Chief Executive Frank Slootman retired and is being replaced by Sridhar Ramaswamy.

This could be a massive buying opportunity for $SNOW, but I’m definitely a little concerned with Frank Slootman leaving.

I’m not exactly sure if I will add more shares or not because of it, but I will be keeping my eyes on $SNOW.

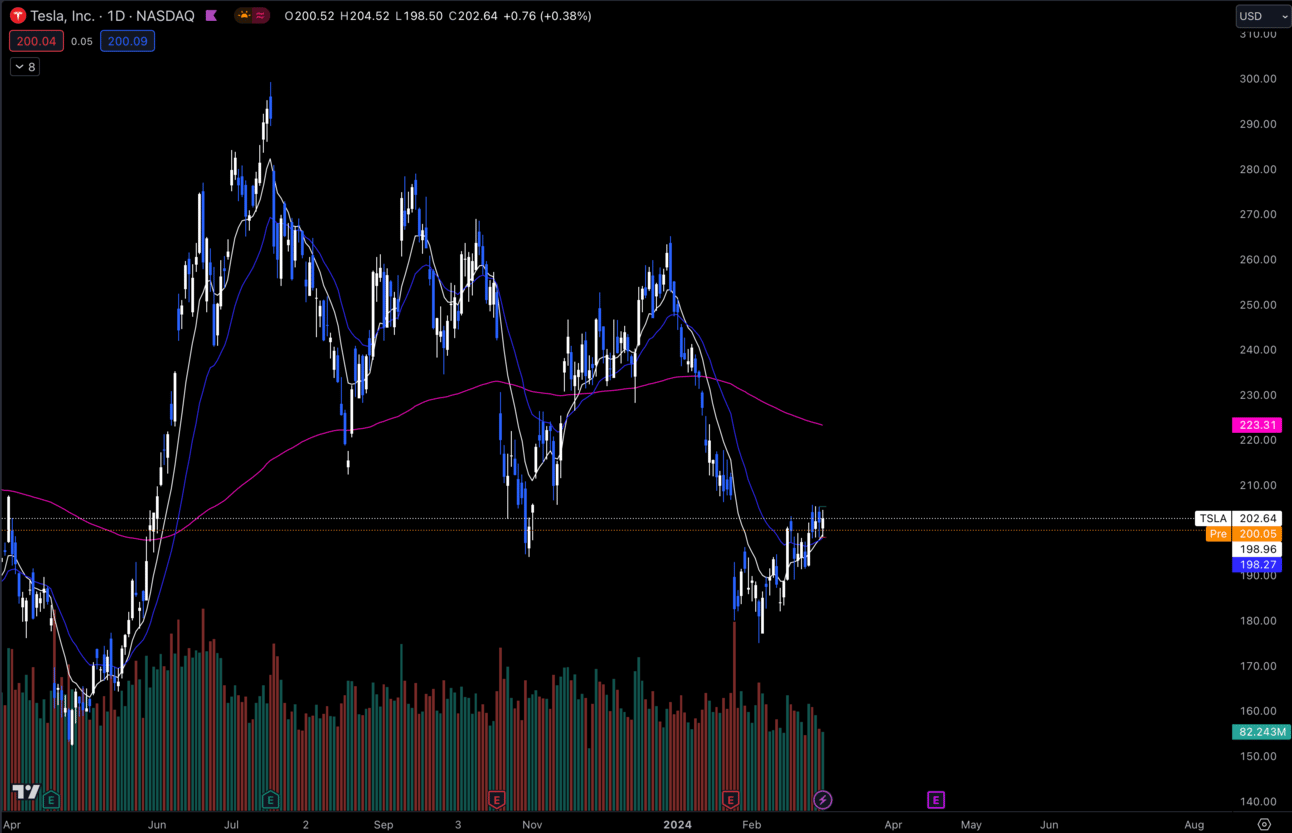

2. $TSLA

$TSLA Daily

Hey look at $TSLA still stuck chopping in that gap! I think we could continue to chop here for even longer which isn’t great.

Although, I think being able to get shares at about $200 is decent. I will continue to add small amounts when I feel is necessary, but I’m just keeping eyes on this one until something special happens.

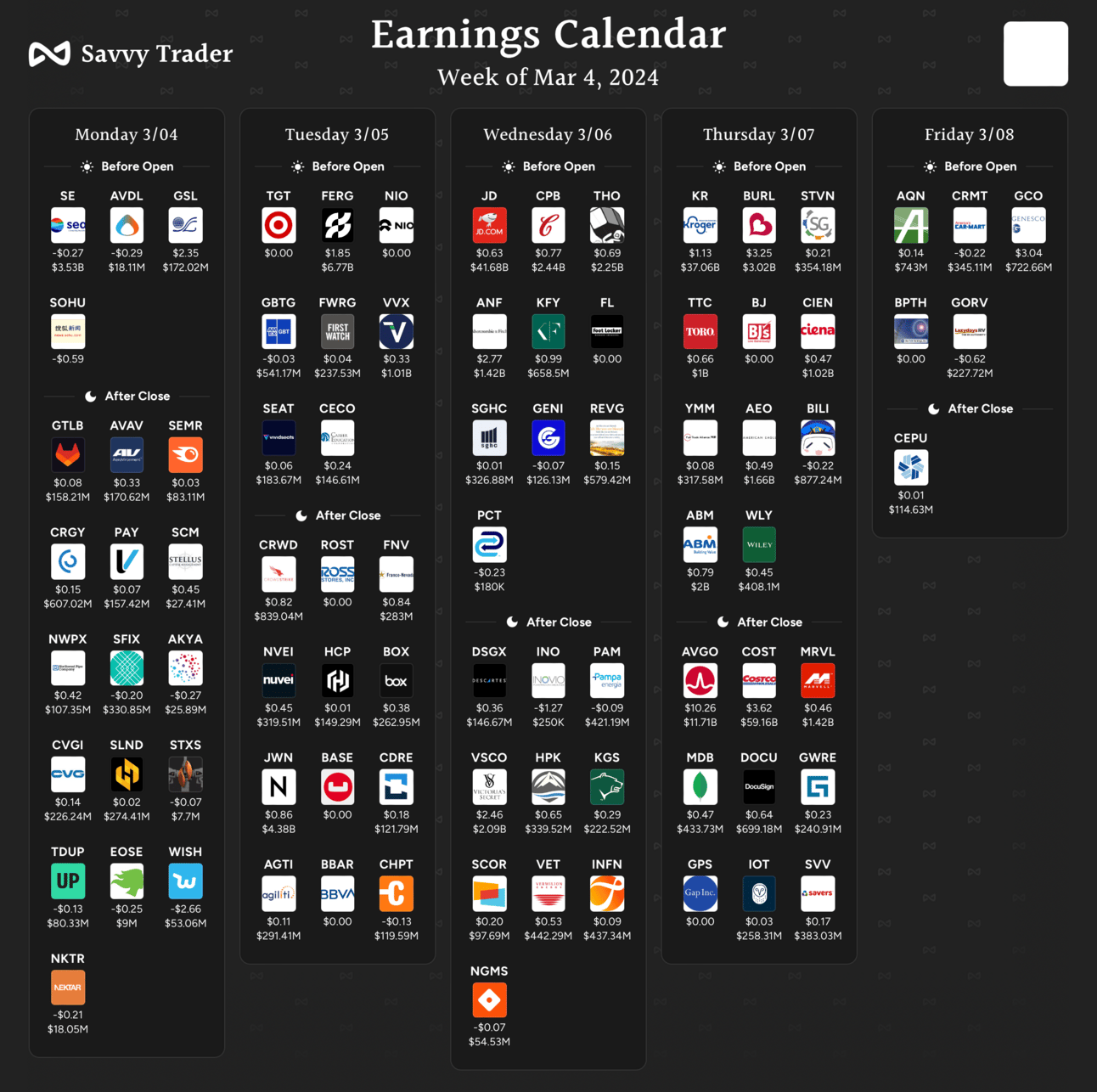

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 9:45 EST, S&P Global Services PMI

Wednesday 10:00 EST, Fed Chair Powell Testifies

Wednesday 10:00 EST, JOLTS Job Openings

Wednesday 10:30 EST, Crude Oil Inventories

Thursday 10:00 EST, Fed Chair Powell Testifies

Friday 8:30 EST, Nonfarm Payrolls

Trending Sectors

Technology and Communication Services were at the top of the list for trending sectors last week.

Trending tickers from last week:

$NVDA

$MSFT

$NFLX

$COST

$DIS

$NKE

$UNH

Have A Great Week!

I hope everybody has a successful week trading, let’s be smart and play our plan!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.