- Ace in the Hole

- Posts

- Ace in the Hole - Edition #11

Ace in the Hole - Edition #11

Your Secret Weapon to Beat The Market

Happy Monday Traders!

Another big week ahead of us!

Last week we saw $SPY gain another 1.67% making new all time highs at $510.13

We have another week of some solid economic data such as GDP.

Day Trading Thoughts

This market continues to be resilient. Every time I’ve tried to flip bearish, bulls come back to show me who is really in control.

Until something really tells me this market is coming down i’m going to continue playing the majority of my positions on the call side.

You can never go wrong following the price action in front of you.

Short-Term Setups For This Week:

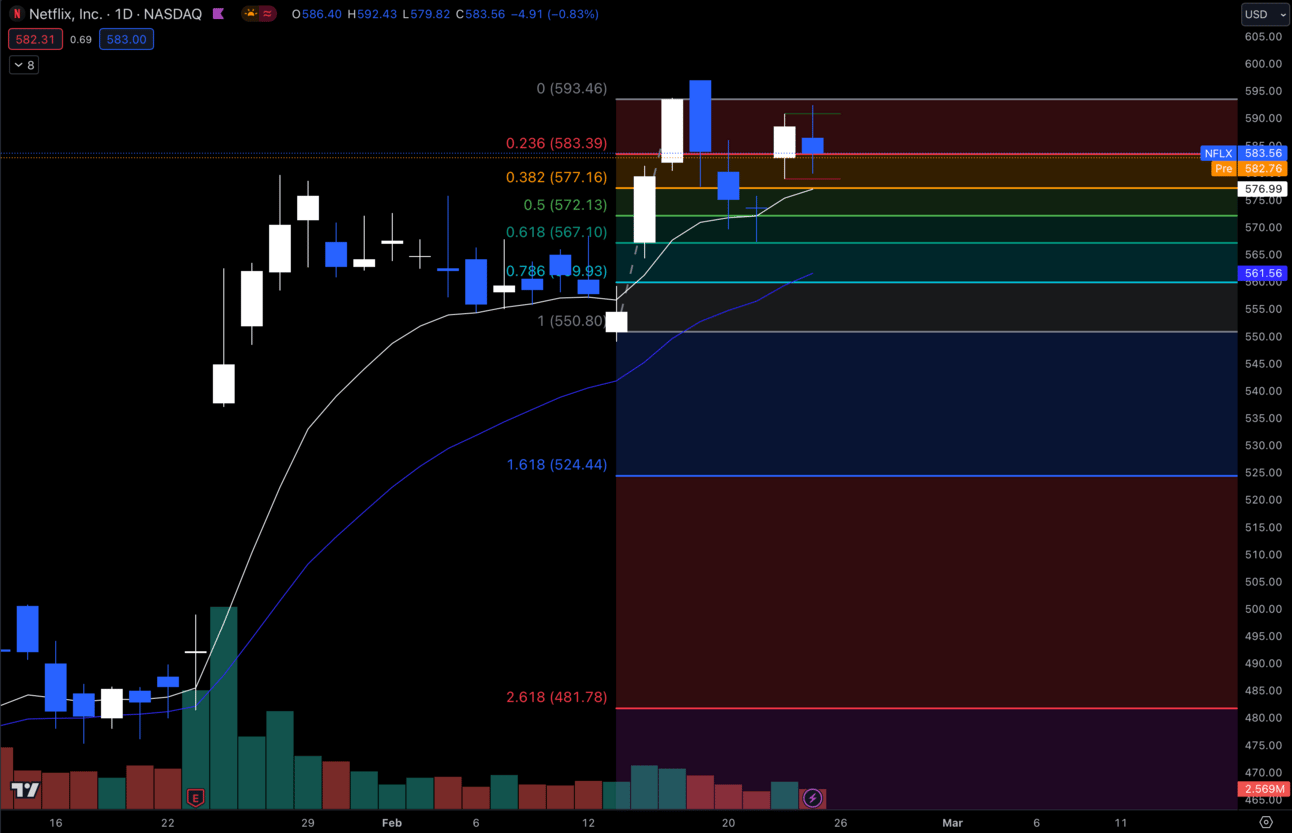

1. $NFLX

$NFLX Daily

Still looking for continuation on this name for new highs. We got the breakout and the retest, now I’m looking for the next leg up.

I have some key fibonacci levels I drew, as long as $NFLX holds the .5 fib I think we get the breakout.

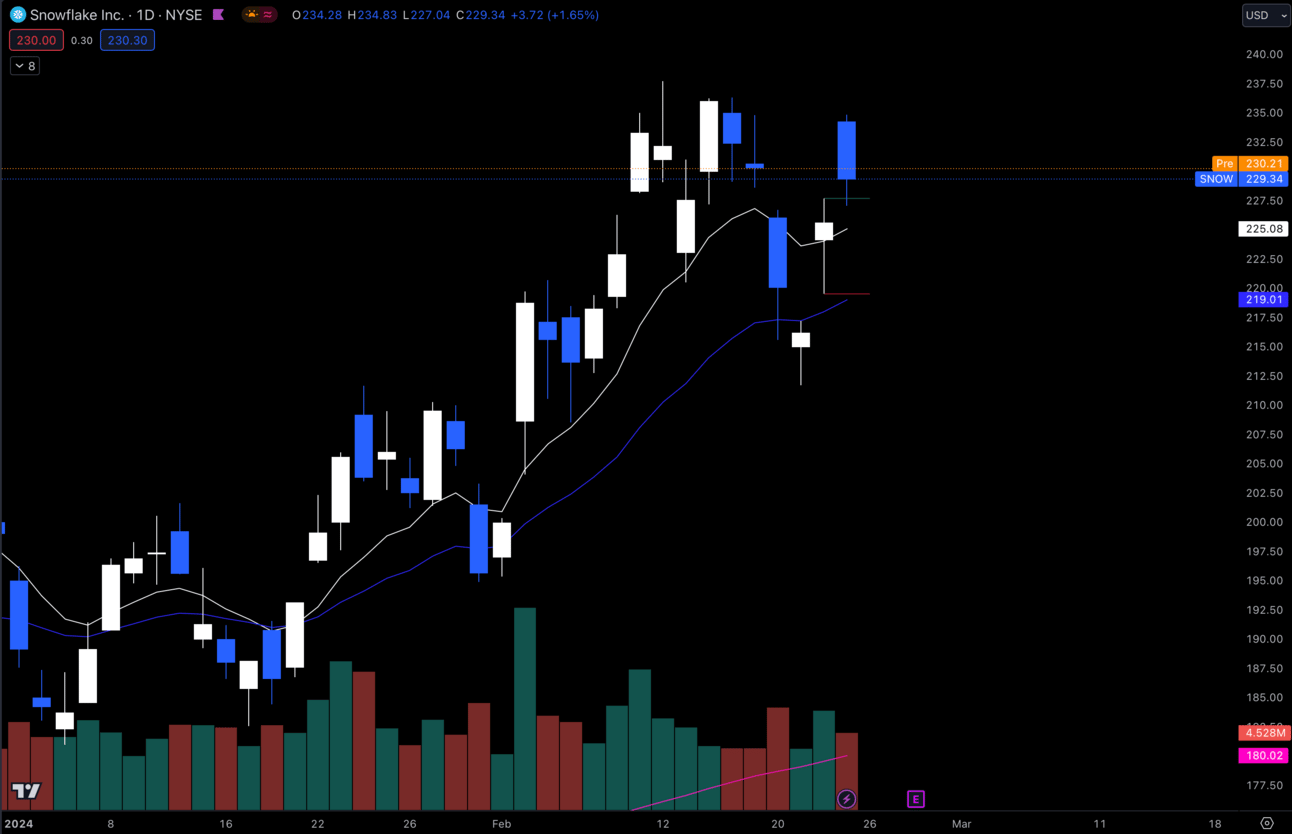

2. $SNOW

$SNOW Daily

Also liking $SNOW with earnings coming up on Wednesday. I personally think earnings will be good, but nothing is set in stone.

Every time this name hits the 21 EMA (Blue Line) it has bounced and made another leg up. I think we see the same here. It already bounced off the 21 EMA, so now I’m looking for the next leg up.

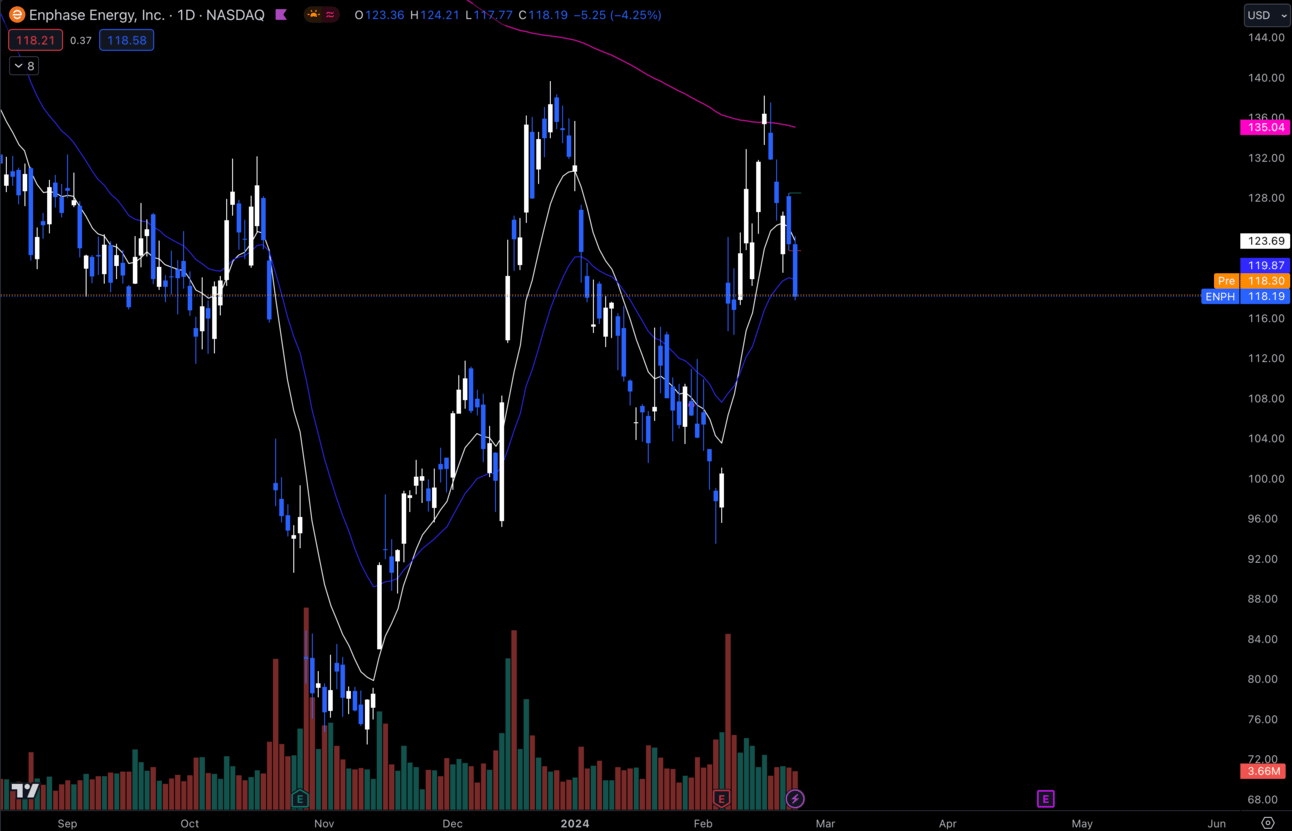

3. $ENPH

$ENPH Daily

I’m liking $ENPH to the downside. It rejected hard off the 200 EMA (Purple Line) making a lower high from previous highs.

I think we fill that gap down from $114.34 —> $101.10.

Long-Term Setups For This Week:

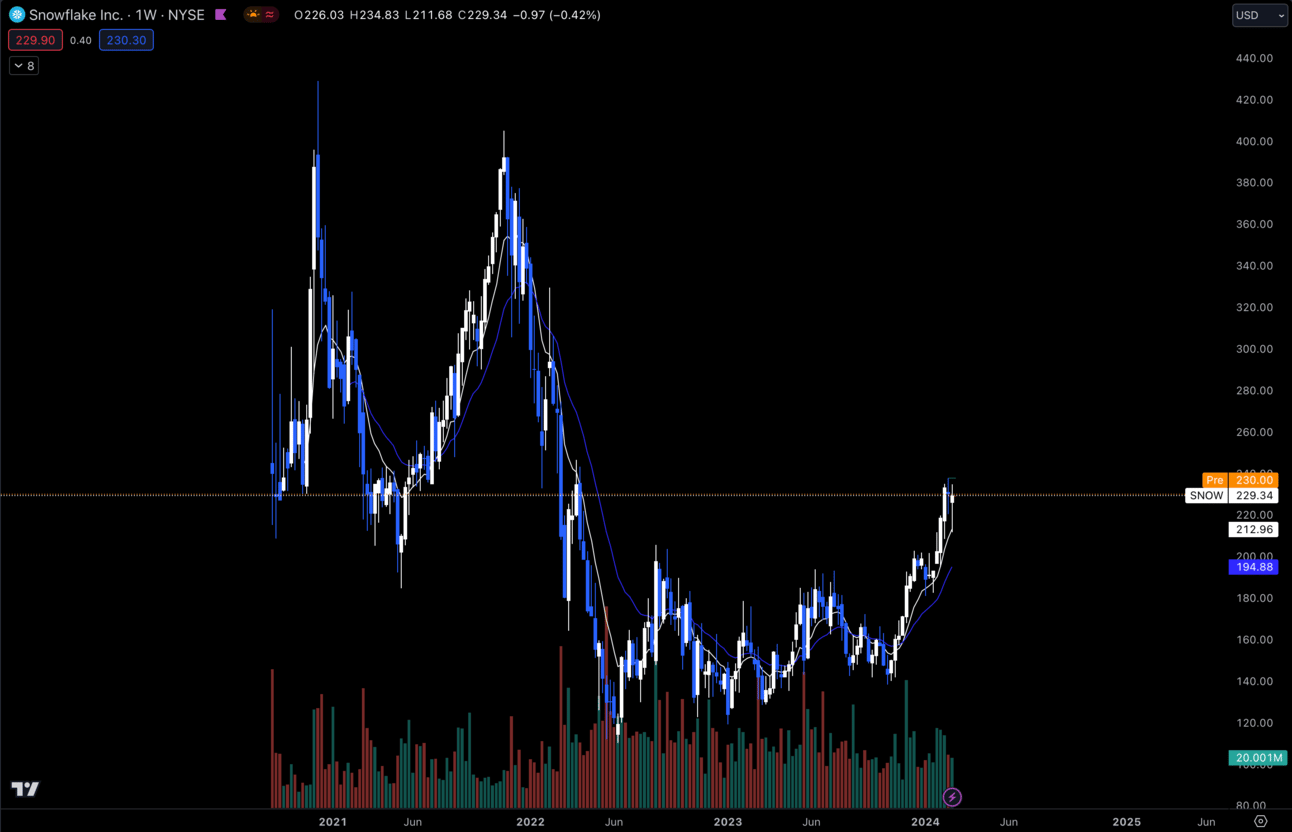

1. $SNOW

$SNOW Weekly

This name has huge upside potential and we have earnings this week.

I’ve been trying to decide whether or not I want to add more shares and I think I do.

I personally think earnings will be good, so I’ll likely be taking a position in this to bring my average up.

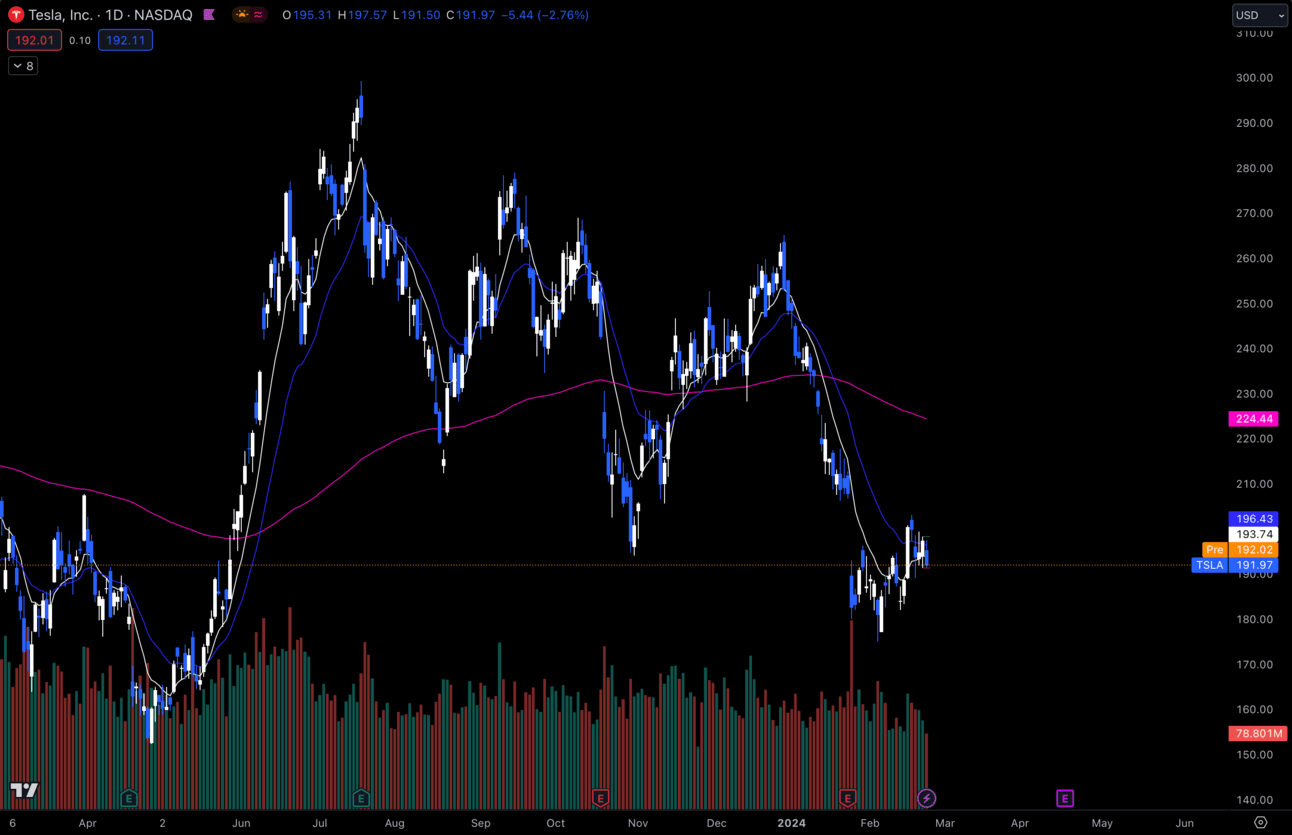

2. $TSLA

$TSLA Daily

$TSLA still underperforming massively. It is trading in this gap where I think we could be very choppy for a while.

It’s boring, but this can be a great spot to be adding to the long-term.

I’ll continue to add at key spots, but not expecting too much excitement here at this moment.

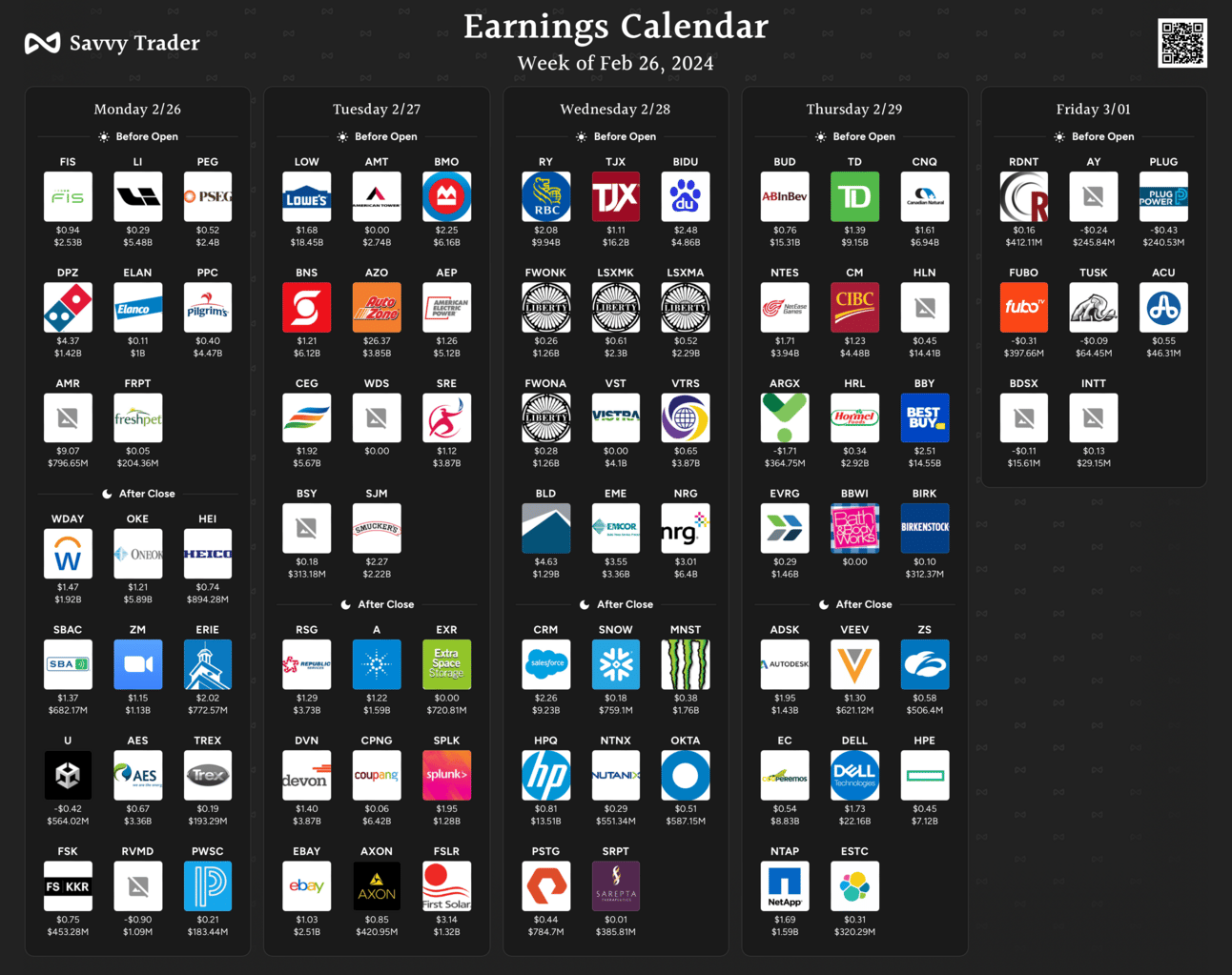

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 10:00 EST, New Home Sales

Tuesday 10:00 EST, CB Consumer Confidence

Wednesday 8:30 EST, GDP

Thursday 8:30 EST, PCE

Thursday 9:45 EST, Chicago PMI

Friday 10:00 EST, ISM Manufacturing PMI

Trending Sectors

AI and Robotics were at the top of the list for trending last week.

Trending tickers from last week:

$AI

$NVDA

$SMCI

$TSLA

$BGNE

Have A Great Week!

As always, enjoy the week and trade safe. Let’s make some $$$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.