- Ace in the Hole

- Posts

- Ace in the Hole - Edition #10

Ace in the Hole - Edition #10

Your Secret Weapon to Beat The Market

Happy Tuesday Traders!

Cheers to the 10th weekly newsletter post, I hope you all had a great long weekend!

Another new week in the market except markets were closed Monday for Presidents’ Day, so we are short a day.

After CPI came out last week I flipped to feeling more bearish on the market, but that quickly changed towards the end of the day.

The last 30 minutes of the market being open I saw the most volume of the day come in all to the upside, so what did that tell me?

It told me that bulls were still in control of this market despite the solid downside move that happened intraday and it very much told the story for the rest of the week.

Day Trading Thoughts

As always I try and remain very neutral when approaching the market day by day, but I could see a potential lower high come in on $SPY here, but i’m not convinced of that at all quite yet.

I’ll be keeping close eyes on $NVDA which reports earnings after close on Wednesday.

Poor earnings for this name could lead to a pullback on $SPY as Semiconductors have been leading this market, but this name has continued to surprise us in the past, so we’ll have to wait and see.

I expect a decent amount of chop until $NVDA reports, but i’m going to play what’s in front of me no matter what.

Short-Term Setups For This Week:

1. $SPY

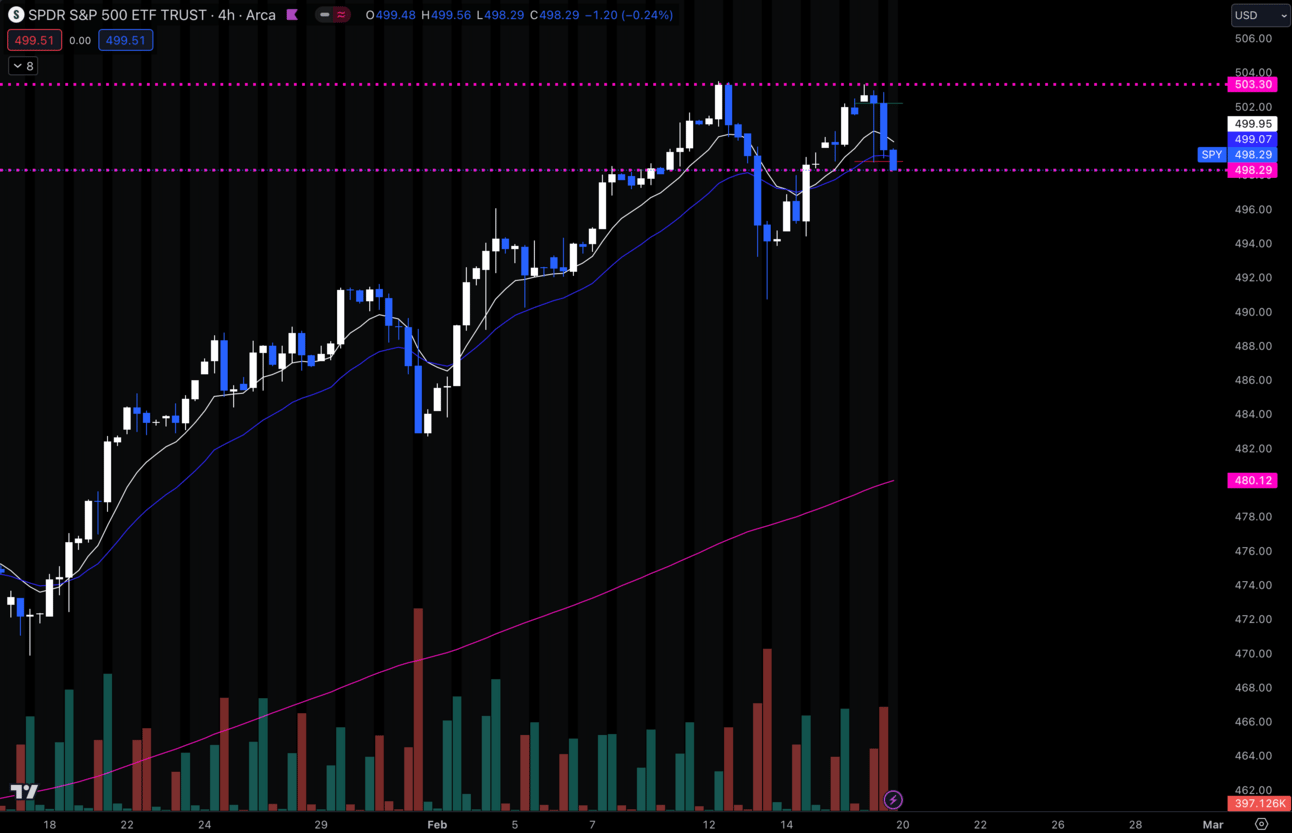

$SPY 4 Hour

I am seeing a double top on $SPY as well as a lower high on $QQQ. I’m willing to play shorts, but I’m staying aware that bulls could still bounce us like they did last week.

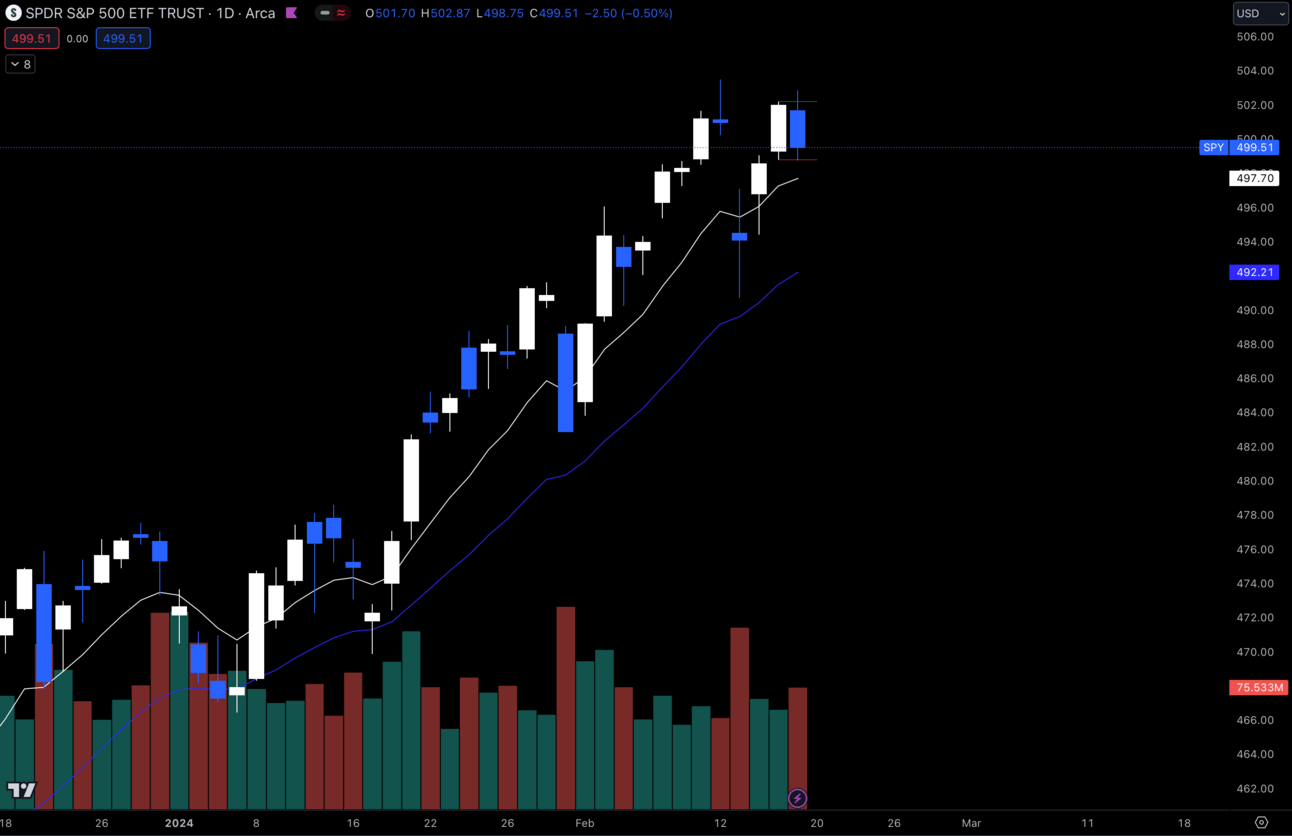

$SPY Daily

Zooming out to the daily, I have my 9 EMA at $497.70. For shorts, i’d like to see a move below that and then try and get below $496.

My last level for bulls to remain in control is $494.20, so I will also be watching that level closely, but again $NVDA earnings will play a big role in where we are headed in my opinion.

2. $AAPL

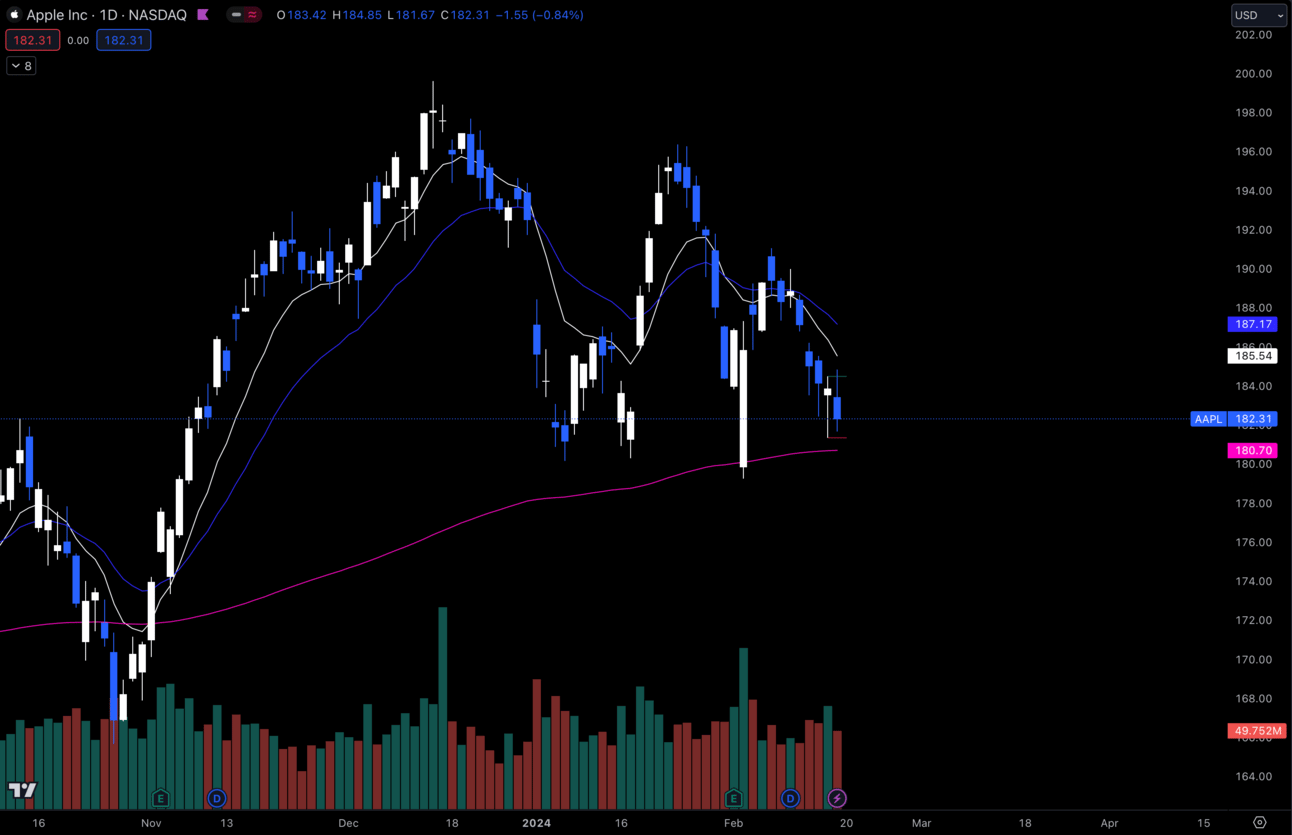

$AAPL Daily

I’m also watching this $180 on $AAPL. We’ve held it pretty well in the past and I’d look for bounces off of that area, but if we crack below it I think we have some room to the downside.

Big levels I see to the downside are $174, $172, and $170 which I would think it would hold if it got there.

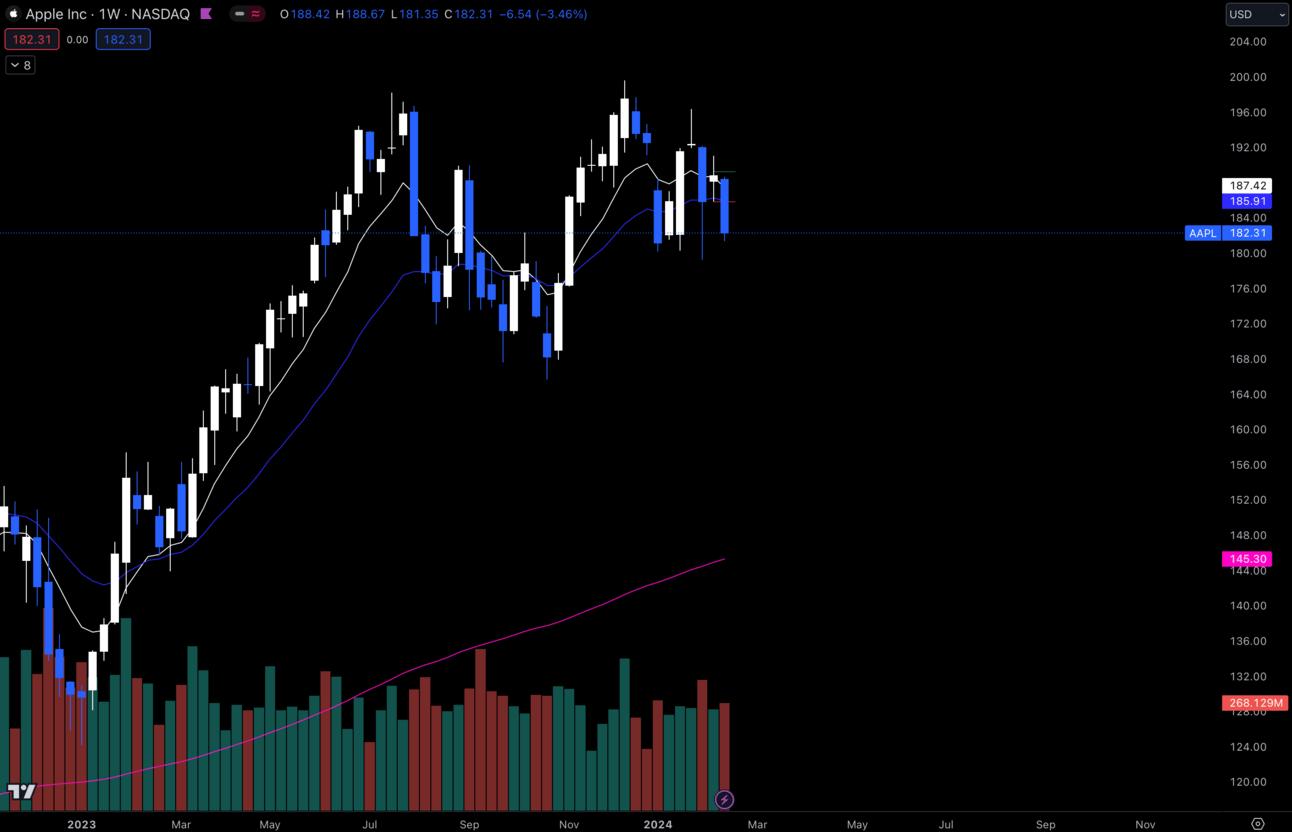

$AAPL Weekly

Zooming out to the weekly chart, I see a lower high that was made a few weeks ago and it is testing that lower demand from month ago.

I personally think the weekly candle coming down into demand looks like it wants to break through that $180, but I will be very cautious for a bounce.

3. $NFLX

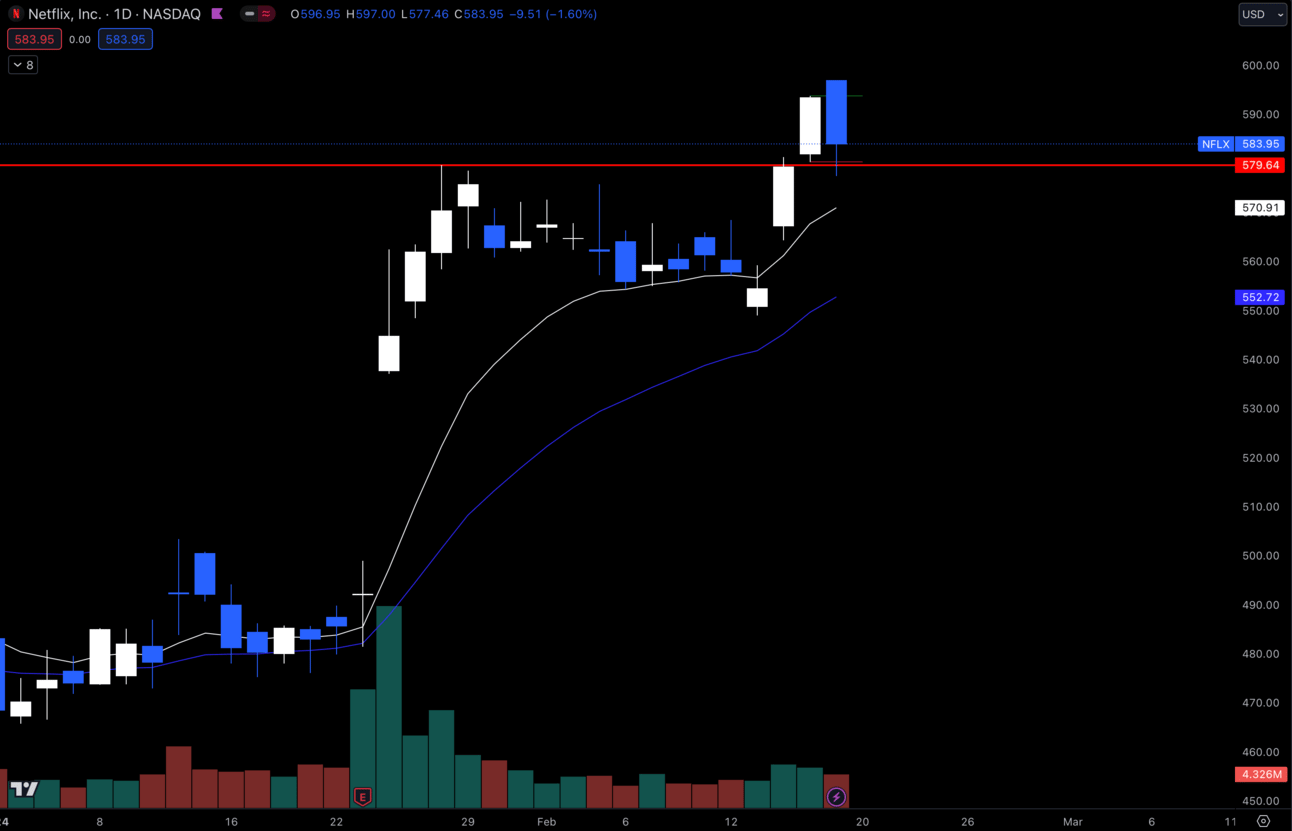

$NFLX Daily

I’ve been catching this break out of $NFLX the past few days which has paid well, but I think it has more in the tank.

Looking at Friday, I definitely saw some people taking profits. Although, it got bought up right off of Thursday’s low which is also the top of the breakout.

This is a classic breakout and retest, so i’m watching for $NFLX to hold that $579.64 area for continuation on this trend.

Levels of resistance I see to the upside are $600, $615, and $630.

Long-Term Setups For This Week:

1. $TSLA

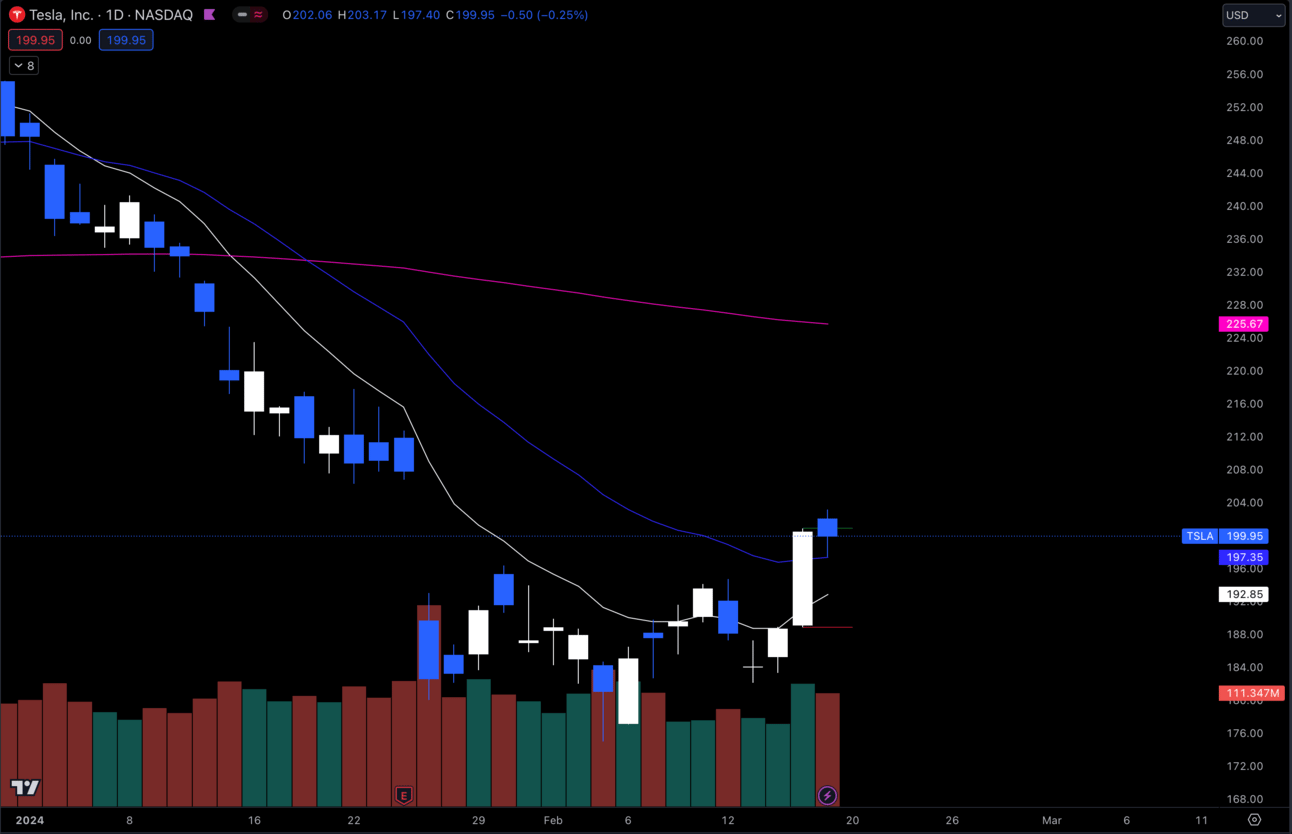

$TSLA Daily

$TSLA is finally catching some bids and testing that gap to the upside. I added some more shares to my portfolio last week and I think it will fill this gap.

I do think we could see some chop around this area as well and I’m not fully convinced of this being bottom, so I will add when I feel it is appropriate.

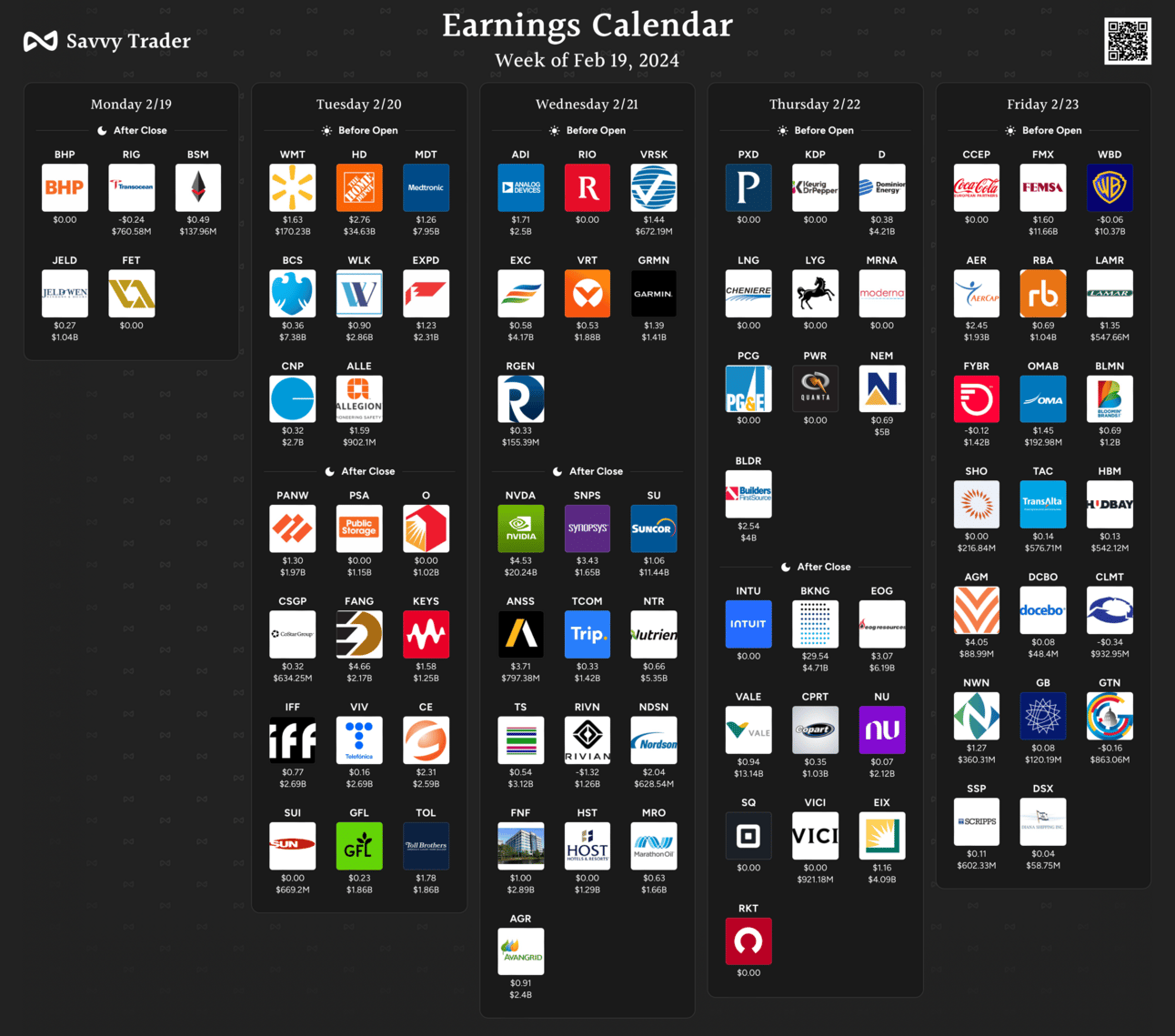

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Wednesday 1:00 EST, 20-Year Bond Auction

Wednesday 2:00 EST, FOMC Minutes

Thursday 9:45 EST, S&P Global US Manufacturing PMI

Thursday 11:00 EST, Crude Oil Inventories

Thursday 12:00 EST, 30-Year TIPS Auction

Trending Sectors

Technology, Communication Services, and Financial Services outperformed the market last week whereas Utilities and Energy were not as prominent.

Tickers that were trending last week:

$NVDA

$MSFT

$NFLX

$COST

$DIS

$NKE

$UNH

Have A Great Week!

Have a safe week trading, I hope everybody plays their plan and makes some money!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.