- Ace in the Hole

- Posts

- Ace in the Hole - Edition #9

Ace in the Hole - Edition #9

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had a great weekend and enjoyed the Super Bowl!

What a crazy week it was with $SPY hitting $500 with a total weekly gain of 1.52%.

This week, there are some big data points that should bring some decent volatility to the market.

Day Traders/Investors

Day traders should be loving the price action that has been provided lately. The choppy days can be tough to trade, unless you can position yourself with the impulsive trend when it’s there.

Last week was a perfect example of this.

Monday, Tuesday, and Thursday were more mediocre days with a ton of chop. Wednesday and Friday had big trend days to capitalize on.

If you can capitalize on the big trends you won’t be worried about sitting out when the price action is terrible.

Investors again should be smiling ear to ear, I know I am.

Long-term portfolios are sky rocketing as the S&P 500 hits new all time highs and gets over $500.

Still nothing is telling me that this is going to stop, but of course I think a pullback is needed.

I do have a small hedge on my long-term portfolio, but will likely reposition myself on that as there is nothing about this market that is telling us it’s done.

Short-Term Setups For This Week:

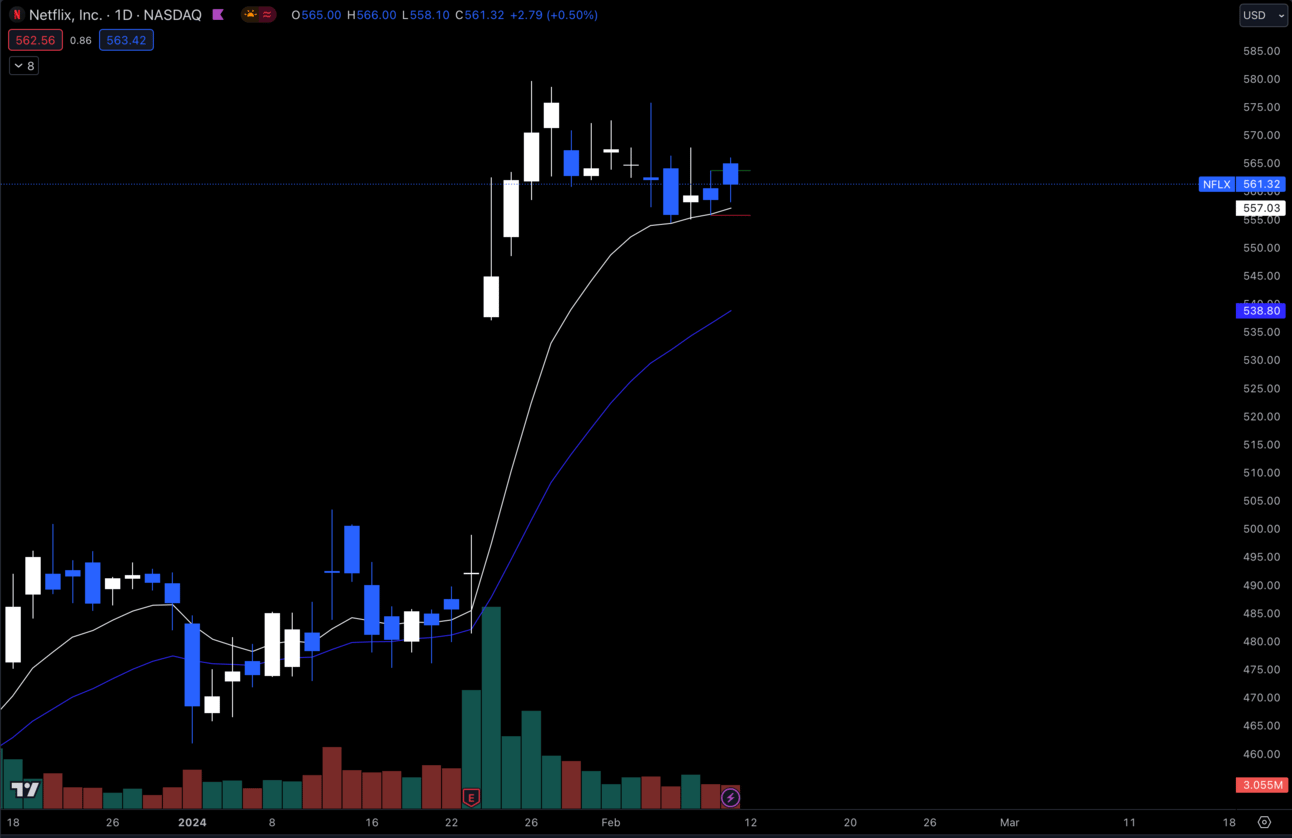

1. $NFLX

$NFLX Daily

$NFLX getting a pullback after the earnings move to the upside. I’m watching how we hold this 9 EMA at $557.03. I personally think this could dip to the 21 EMA at $538.30.

Either way, i’m waiting for a trigger long which would be a daily candle close above previous daily candle high.

I would be aware that if $NFLX gets the dip to the 21 EMA, that means it’s getting close to the earnings gap on the daily which could be bad if we start trading into that gap.

If we can break out of that $580, I see next big resistance at that $615 area, but of course $600 will be a big physiological level as well.

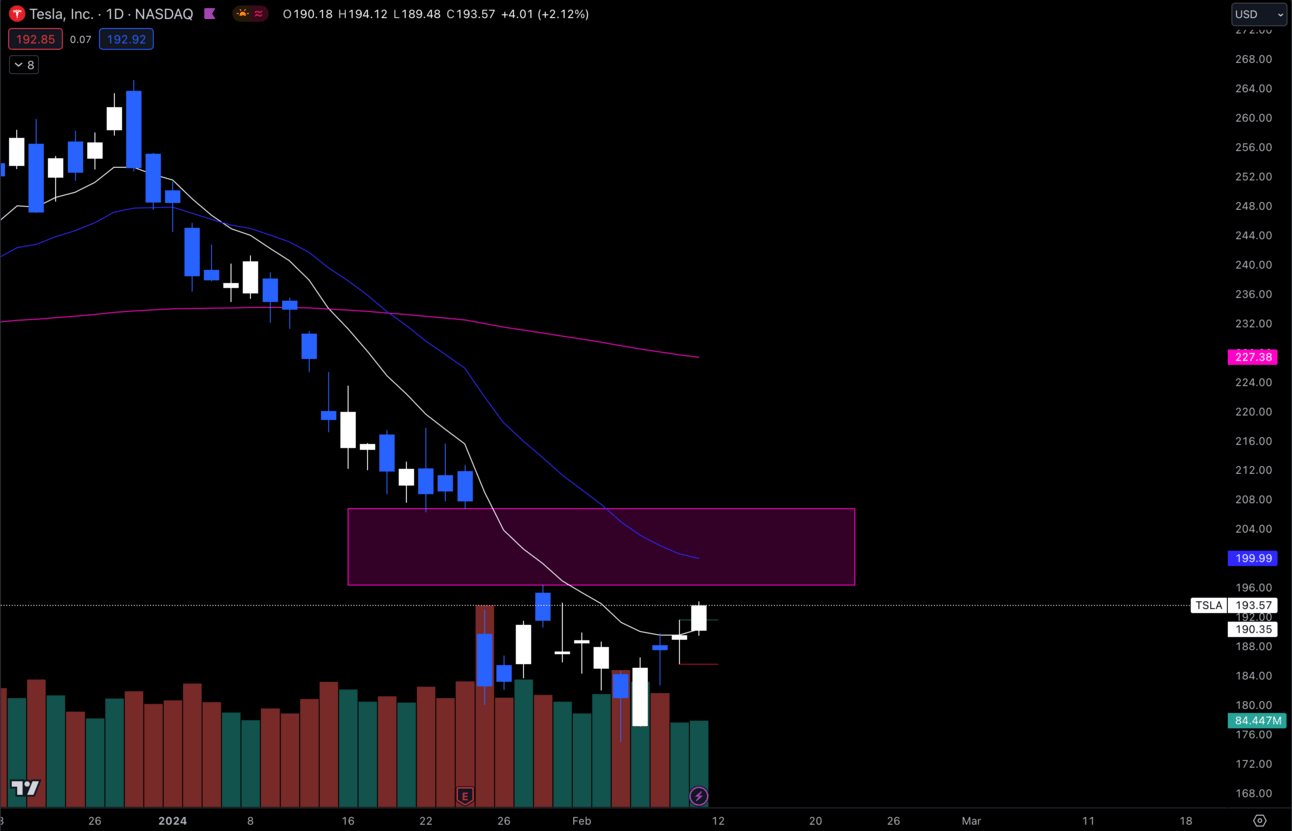

2. $TSLA

$TSLA Daily

Still watching $TSLA at these lows. It’s headed towards that gap from $196.36 —> $206.77 which I would love to see it fill.

I’m still not convinced that this is bottom yet, but this is starting to look juicy. On the flip side, if this isn’t trending I really wouldn’t trade it.

$TSLA can be one of the most difficult tickers to trade when its a choppy day, so just be careful.

Would also love to see a weekly close above last week’s high.

Long-Term Setups For This Week:

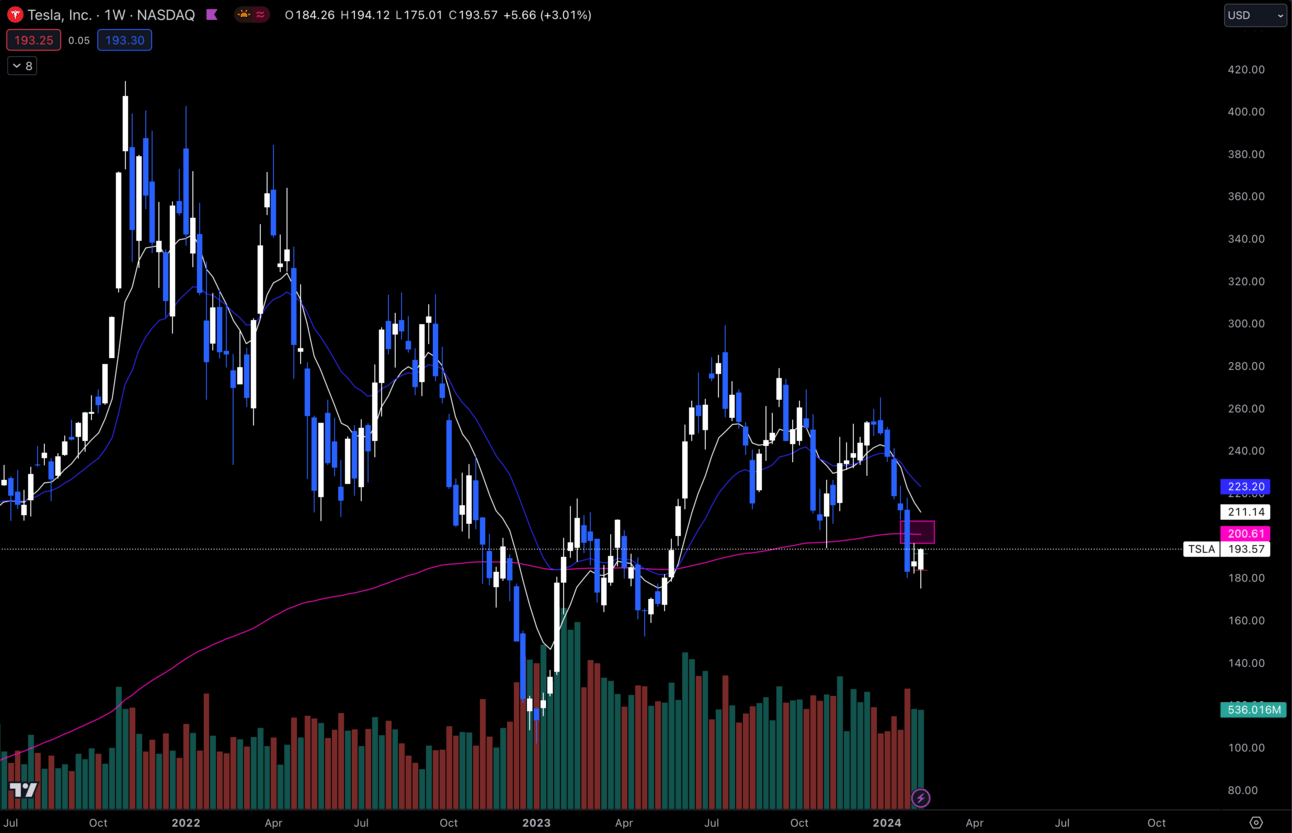

1. $TSLA

$TSLA Weekly

I won’t keep boring you with the same $TSLA analysis, but i’m still watching this for more long-term adds. Massively underperformed relative to the $SPY and I love it at these prices.

I’m personally waiting to add more until I get confirmation of this being bottom.

Not too many setups this week guys. This market has been relentless, so i’m just going to position myself with the trend when its there and try my best to stay out of the chop.

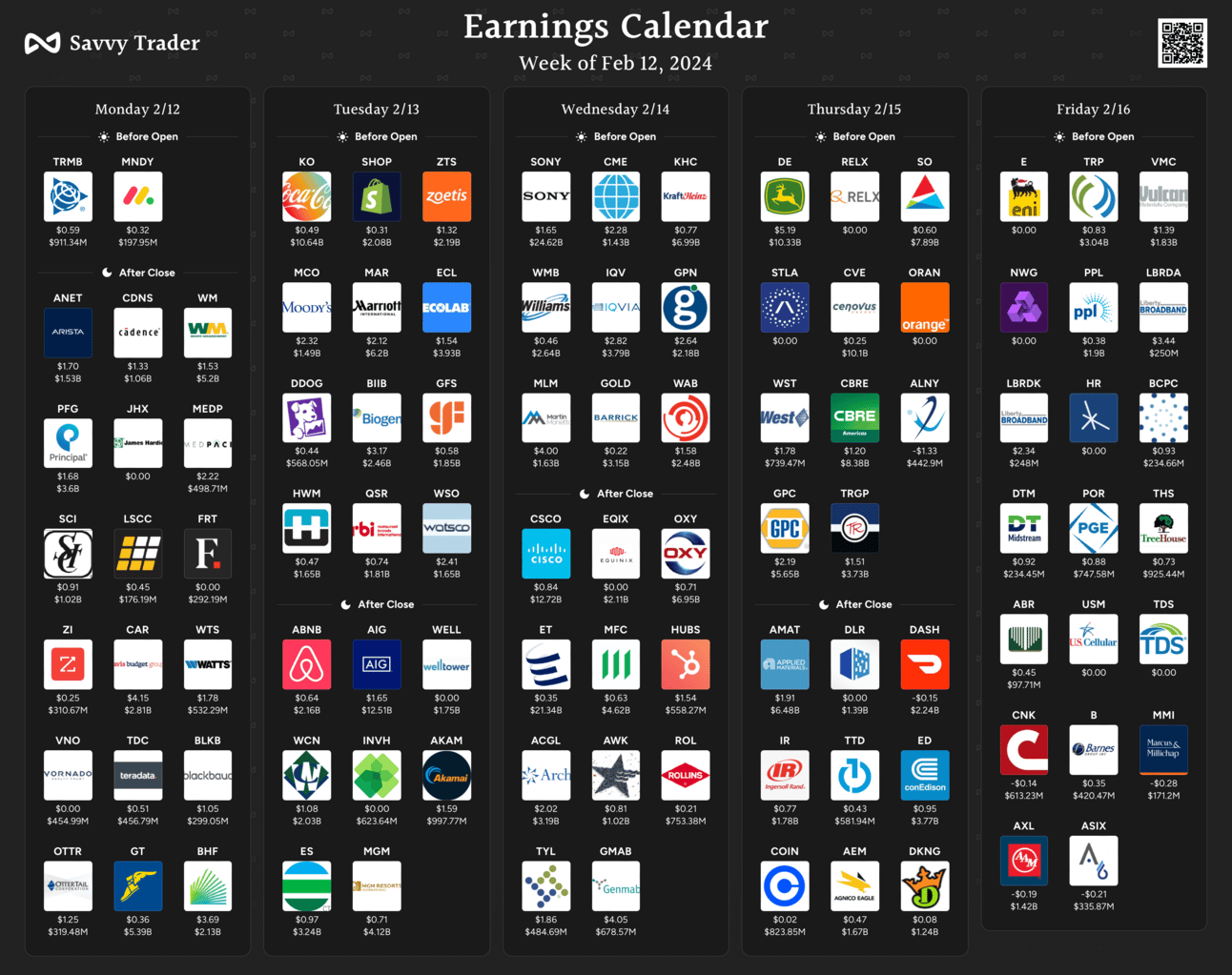

Earnings Calendar:

Economic Calendar:

These data points are known to bring volatility during the intraday.

Tuesday 8:30 EST, CPI

Wednesday 10:30 EST, Crude Oil Inventories

Thursday 8:30 EST, Retail Sales

Friday 8:30 EST, PPI

Trending Sectors:

Biotech and Software Infrastructure were at the top of the trending list last week.

Tickers that were trending last week:

$CTLT

$HUBS

$XPEV

$NYCB

$SR

$FOX

$GPN

$SPWR

$HII

$BL

Have A Great Week!

As always, enjoy the week, trade smart and have fun!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.